Checking Out New York City Residential Or Commercial Property Financial Investment Opportunities: A Overview for Savvy Investors

New York is a prime area for residential or commercial property investors, offering varied investment chances across its city facilities, suburbs, and picturesque backwoods. The state's vibrant property market brings in a range of financiers, from those interested in high-yield rental residential properties to those concentrating on long-term asset growth through commercial or domestic advancements. Comprehending New york city's financial investment landscape, crucial regions, and property types will equip investors with the insights required to navigate this competitive and rewarding market.

Why Purchase New York Realty?

New york city supplies numerous engaging reasons for home investment:

High Demand: With NYC as a global organization center, rental need stays robust. The state's residential and commercial properties satisfy a series of requirements-- from families and students to specialists and businesses.

Diverse Market: Financiers can discover profitable possibilities in a range of industries, consisting of business, domestic, industrial, and retail.

Growing Populace Centers: Upstate New York's populace facilities and NYC's 5 boroughs attract people with job opportunities, lifestyle, and facilities, contributing to property appreciation and rental need.

Prospective Tax Rewards: Particular zones in New york city offer tax benefits, which can be useful for long-term property financial investments and developments.

Leading New York Property Investment Markets

1. New York City City (NYC).

New york city is a significant tourist attraction genuine estate investors, with areas across the 5 districts offering differing levels of financial investment possibility.

Residential Rental Qualities: NYC's high population density and regular influx of brand-new residents make it a prime area for rental financial investments. Areas like Brooklyn and Queens, particularly, see high need for rentals, making them eye-catching for multifamily investments.

Business Realty: Office and retail area continue to be strong possessions in Manhattan, specifically in commercial districts like Downtown and Wall Street. Post-pandemic, there's additionally demand for flexible workplace.

Deluxe Developments: Neighborhoods like the Upper East Side and Tribeca continue to attract high-net-worth people, making luxury apartment or condos and apartments a profitable investment.

2. Long Island.

Close to New York City, Long Island uses rural living with closeness to the city, making it a favorite for households and specialists looking for a quieter atmosphere.

Single-Family Houses: Long Island's Nassau and Suffolk regions are preferred for single-family homes, specifically in suburbs. These areas interest family members searching for high quality college areas and secure areas.

Seasonal Rentals: The Hamptons and Fire Island are hot spots for getaway leasings, specifically in the summer season. Seasonal rental residential or commercial properties in these areas provide outstanding rois.

Multifamily Real estate: With restricted housing availability in NYC, Long Island's multifamily units offer an economical option for those commuting to the city, making these properties a profitable financial investment selection.

3. Hudson Valley and Upstate New York.

For investors interested in even more cost effective realty with possibility for appreciation, Hudson Valley and Upstate New york city supply different possibilities.

Rental Features: The Hudson Valley's closeness to NYC makes it a preferred option for commuters and remote employees. Cities like Beacon, New Paltz, and Kingston have seen raised demand for leasings and 2nd homes.

Tourism and Vacation Properties: With breathtaking landscapes and outside recreational tasks, areas around the Adirondacks, Finger Lakes, and Catskills attract visitors year-round, making temporary leasings profitable.

Trainee Housing: Albany, Syracuse, and Rochester are home to significant universities. Capitalists in these cities can profit from the consistent need for student real estate by purchasing multifamily or studio apartment buildings.

4. Albany.

New York's resources provides a stable real estate market with opportunities in property and industrial fields. Its stable economic climate, strengthened by federal government tasks and technology startups, makes Albany an appealing location for rental property financial investments.

Multifamily Investments: Albany's multifamily units, particularly around government offices and colleges, are in demand by trainees, specialists, and families.

Industrial Space: Albany's economic climate is developing, with development in the modern technology industry creating demand for workplace and coworking environments.

Single-Family Houses: Albany's neighborhoods offer price and a slower pace than New York City, attracting households and retired people searching for affordable housing.

Techniques for Effective Residential Property Financial Investment in New York.

For investors aiming to take advantage of New York's competitive market, right here are some actionable strategies:.

1. Evaluate Market Trends by Location.

Each area of New York has special economic drivers and residential property demand. Thoroughly investigating the details city or community can reveal understandings into lasting productivity. As an example, while NYC offers high rental yields, Upstate New York may provide far better lasting gratitude possibilities.

2. Understand Regional Rules.

New york city has different home policies, particularly relating to rental homes. NEW YORK CITY, for instance, has certain rules for short-term leasings, zoning, and lessee rights. Comprehending these policies aids financiers prevent fines and legal difficulties.

3. Focus on Rental Need.

Rental demand is strong in city and suburbs alike, supplying outstanding opportunities for consistent revenue. By concentrating on rental residential or commercial properties-- whether temporary, mid-term, or long-lasting-- investors can capitalize on consistent cash flow. In locations like the Hamptons and Hudson Valley, seasonal leasings can likewise supply significant revenue.

4. Think About Building Management.

If investing in areas far from New York City, residential or commercial property monitoring is vital for remote landlords. Working with a dependable building management company aids preserve rental buildings, manage occupants, and take care of daily procedures. This strategy guarantees a favorable rental experience and reduces the financier's hands-on time commitment.

5. Take Advantage Of Financing Choices.

Safeguarding financing is crucial, especially in competitive markets like New https://sites.google.com/view/real-estate-develop-investment/ York City. Capitalists can take advantage of funding options such as mortgage, industrial car loans, and collaborations, which can aid maximize purchasing power and enhance returns.

Future Patterns in New York City Property Financial Investment.

As New york city's real estate market progresses, financiers can expect new opportunities and difficulties:.

Remote Work Effect: The increase of remote job has actually improved housing demand, particularly in suburban and Upstate areas, as people try to find even more budget-friendly choices outside NYC.

Sustainable Advancement: Environment-friendly growths and environment-friendly structures are getting appeal, especially in metropolitan centers. Characteristics with sustainable features may bring in eco aware occupants and purchasers.

Enhanced Interest in Secondary Cities: Cities like Albany, Buffalo, and Rochester are attracting rate of interest for their budget-friendly residential properties and enhancing regional economies, developing financial investment capacity beyond New York City.

New York's real estate market gives varied residential property investment chances, from Manhattan's high-rises to Hudson Valley's rolling landscapes. Investors can capitalize on various residential property types and places depending upon their goals, be it rental revenue, residential or commercial property gratitude, or long-term wealth growth. By understanding neighborhood market characteristics, staying informed on regional laws, and selecting the best residential property administration techniques, capitalists can accomplish lucrative outcomes in among the nation's most amazing residential property markets.

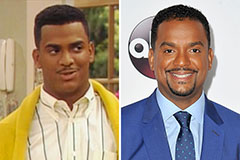

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now!